Do you want to know the easiest way to save £667 in just one year?

The Save a Penny a Day Method: the Beauty of Compounding

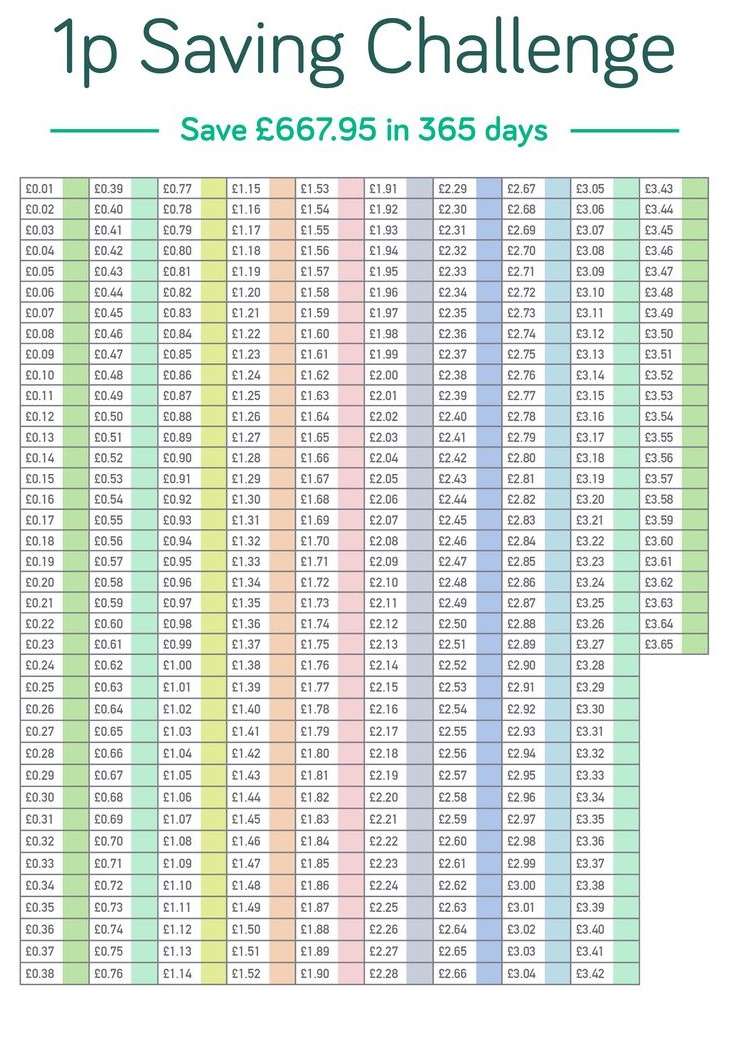

The save-a-penny-a-day challenge works on compounding/cumulative saving, meaning whatever day of the year it is, you’ll be saving the same number of pennies as the day number, so the saving amount increases each day. So if 1st January is day 1 (depending when you start), 31st December is day 365.

As Albert Einstien said of compounding: “Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t, pays it”. And it’s the same with a compound or cumulative savings plan. Your balance will grow surprisingly quickly, as you’ll see on the image/spreadsheet we’ve provided.

How it Works

It’s designed to start on 01 January but really you can do it anytime you like. Whenever you begin, at the end of 12 months you’ll have £667.95. All you have to remember is what number day you’re on. But you don’t even have to remember, as we have a spreadsheet for you.

There is also a reverse version of this savings challenge, meaning you start by saving the highest amount on day 1, so for 2025 that would obviously be £3.65, ending with £0.01 on day 365.

We would suggest using the spreadsheet to mark off each time you’ve saved that day’s amount – we’ve done the hard work for you already. Or you could use a jotter or notebook if you prefer and just add it up manually – it’s entirely your choice.

This is a great way to save money and if you continue this, come the end of a year you will a have accumulated a massive £667.95. Imagine what you could do with that lovely sum of money. You could also stop the challenge a month early and use the cash for your Christmas shopping, or perhaps a personal treat or mini break away. It’s entirely up to you how to do any savings/spending challenge.

How The Save A Penny A Day & Reverse Penny A Day Challenges Works

- Start by saving one penny on the first day.

- Then, each day that follows, add one penny to the amount you saved the day before. For example, on day two, you’ll add 1p, on day three you’ll add 3p, and so on. But the most you’ll ever have to put in is £3.65 on day 365, or obviously £3.66 in a leap year.

- Continue this pattern every day for 12 months.

- For the reverse challenge, you’re starting with £3.65 (£3.66 in a leap year) on day 1 and decreasing the amount you save by 1p each day, ending with 1p on day 365/366.

- The final amount you end up with is the same in both challenges.

- We suggest setting up a named savings account on your banking app, if you use one.

- If you prefer to transfer a weekly amount into your Penny a Day account, just add up the days for that particular week and transfer that amount.

If you Save Regularly, you’re Developing Financial Discipline

When you save small but regular amounts, you get into the habit of saving. This means you can build up a savings pot without committing too much money to it. For new savers, or the undisciplined, it’s more effective than saving sporadically, and it teaches discipline.

If you stick to your daily savings challenge, you may find you enjoy it and start coming up with more creative ways to raise the money you need to save each day. And you will definitely enjoy seeing that balance growing. You may also discover that it spurs you on to set up more money-related challenges, and we’ll be adding more of these in the future.

Click one of the following links to download the spreadsheet for both challenges from our Google drive:

If you would like to find a licensed financial advisor in the UK, check out this website.

Please note we are not financial advisors. The information we provide is intended for educational and entertainment purposes only. Please see our disclaimers for further information.