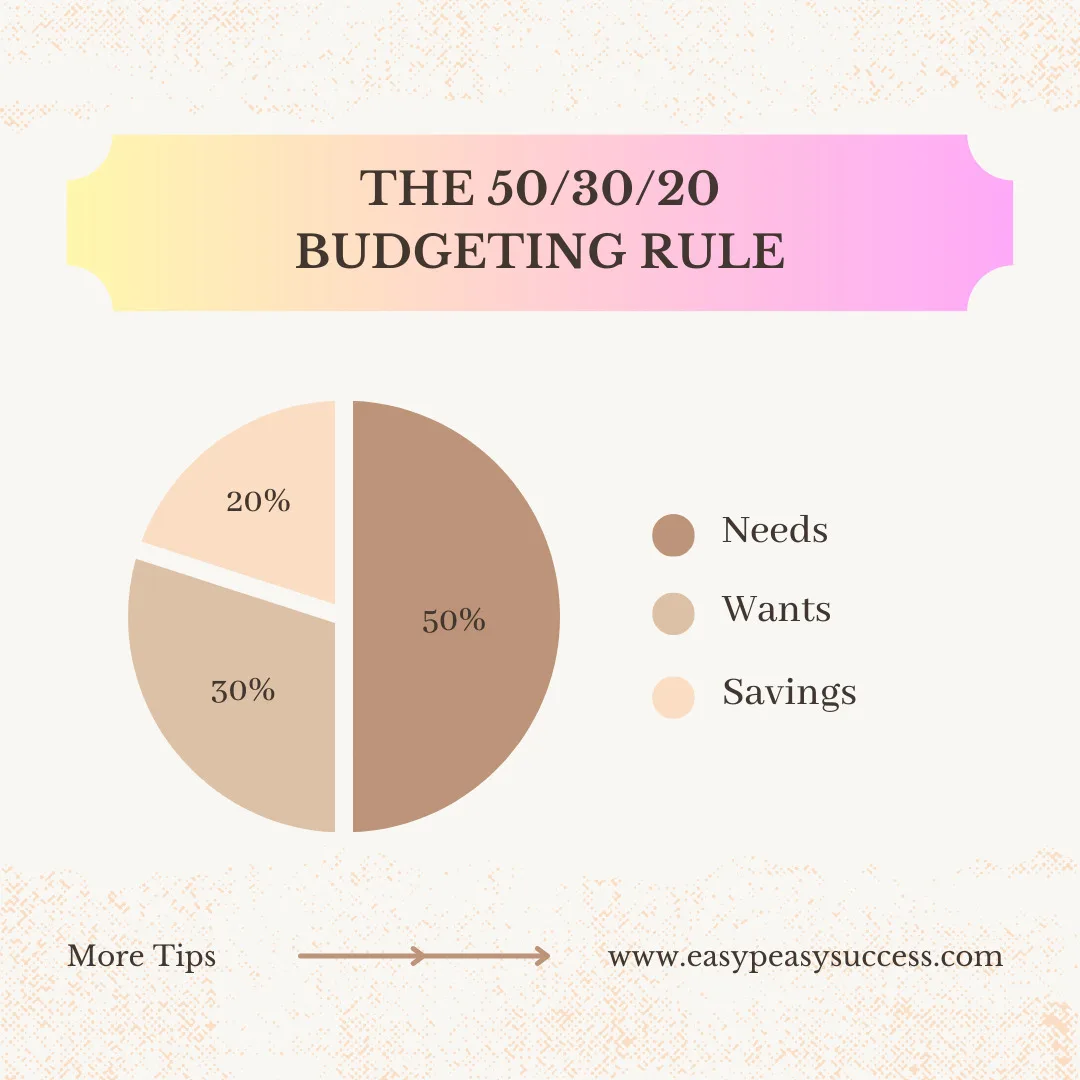

If you want to achieve financial stability in your life, then the 50/30/20 budgeting method could be just what you need.

In the maze that is personal finance, 50/30/20 budgeting stands out as a practical guide for achieving financial mastery. This rule, often lauded for its simplicity, offers individuals a structured yet flexible framework to apportion their income, enabling financial objectives to meet achievable targets.

How To Achieve Financial Stability: the Nitty Gritty

This is how the 50/30/20 method works.

Rule 1

Starting with necessities, 50% of your earnings are earmarked for essential expenses such as housing, utilities, and groceries. This ensures your basic needs are met first, safeguarding you and therefore leaving you less vulnerable to external financial events.

This section will also include your regular debt repayments.

Rule 2

The next area to look at is your wants, and you’ll allocate 30% of your income to these. Anything that is a want, rather than a need, fits into this category. Think leisure activities, hobbies, eating out, holidays, etc. Basically, anything that gives you pleasure, rather than being a basic need. If you like to grab a coffee on the way to the office, or lifestyle magazines when you’re doing the food shop, make sure you include that spending in the 30%.

Rule 3

The remaining 20% of your income is allocated to savings. Ideally, this will encourage you to build long-term financial robustness (giving you more security for the future). But it can also be used for shorter-term goals, such as large purchases.

We have some ideas for savings challenges in our freebies section, with more coming soon. It’s important to set goals if you want to save for something out of the ordinary.

Long-term savings can include investments, regular savings into schemes like ISAs (in the UK), stocks and shares, or a private pension plan if you’re not in a company scheme.*

What Does Financial Security Mean to You?

It’s important to identify what financial security means to you personally, as it’ll be different for each person. Some people might want to have a year’s salary locked away safely, while for others, it could be 3 months. Our individual circumstances will determine where we save our 20%. It’s important we make it fit us, not someone else.

For it to work correctly, the 50/30/20 rule requires meticulous planning (initially) and steadfast commitment from you. If you’re looking for financial security, this method could be the answer. Having that security could mean reduced stress and more resilience against market forces (that you can’t control).

And Finally

Because you’re allocating all of your income up front, you’re less likely to waste money on mindless spending. Financial planning – whether that’s a budget, savings challenge or food shopping list – saves you time, pressure, and ultimately, money. And it brings with it the increased self-confidence that comes from being in complete control of your finances.

Financial Advice

*Please remember, we are not financial advisors and cannot give advice on financial matters. The information provided on our site is based on our own experiences and knowledge. Always do your own due diligence and speak to a qualified person before investing in any schemes, plans, or stocks and shares. Our Amazon suggested reading list has many books on different aspects of personal finance.

Disclaimer

This site uses affiliate links. Please refer to our disclaimers for details on how this may affect you.